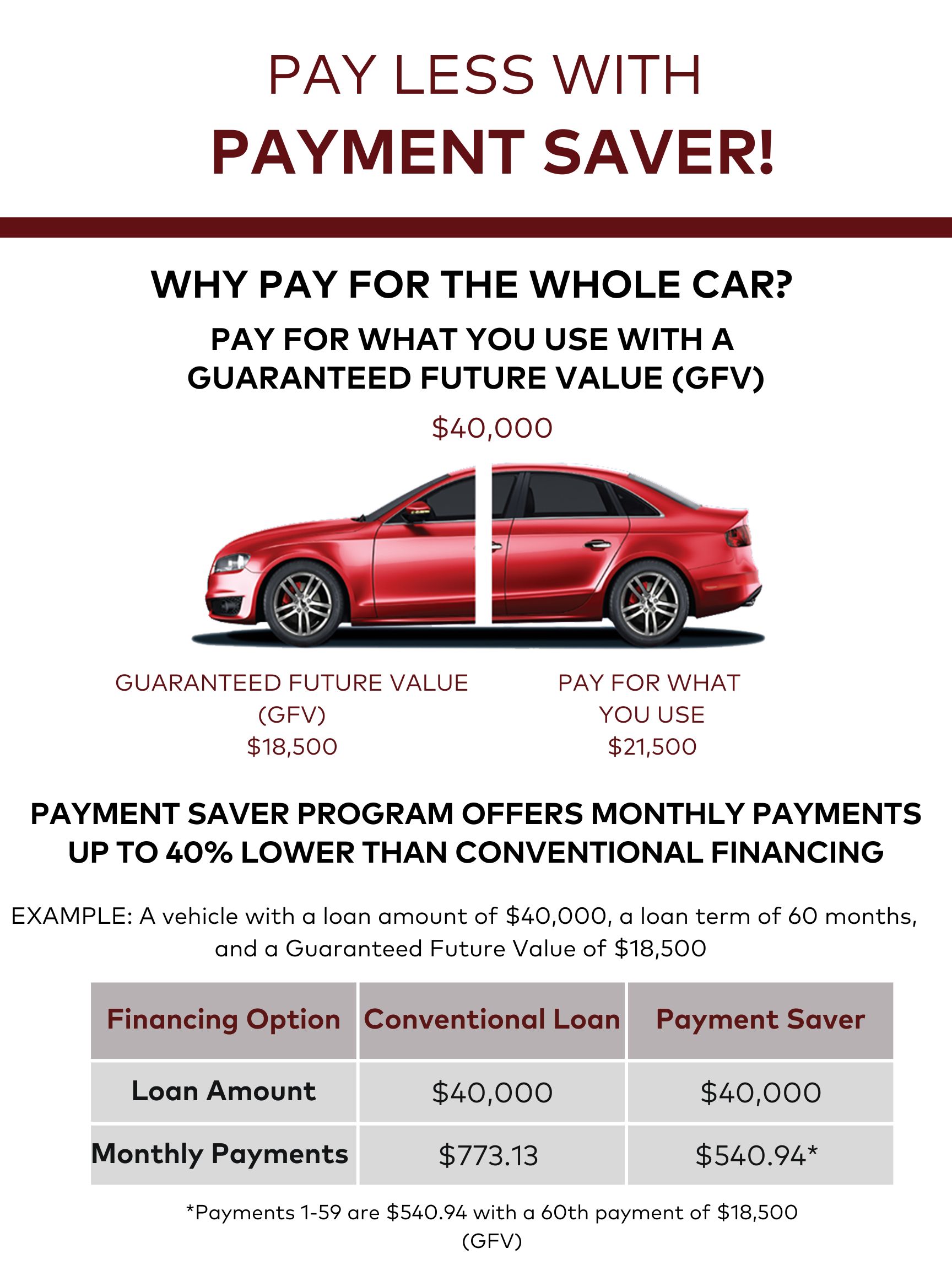

GPO's Payment Saver is a financing option that offers monthly payments that are considerably lower than conventional financing!

It's a lease-like program, but you OWN the vehicle, and there are plenty of end-of-term options:

- Refinance remaining balance and keep the vehicle.

- Sell it at maturity or anytime during loan term.

- Trade it at maturity or anytime during loan term.

- Return the vehicle at maturity in lieu of final balloon payment.

New AND used vehicles (up to five years old) qualify for the Payment Saver program. With terms ranging from 24 to 72 months, discover how Payment Saver makes sense for your auto financing needs.

See How Low Payments Can Go!

Compare GPO's Payment Saver to conventional auto financing.